IBEX

Verified, Audited, and

Repeatable Alpha

Performance You Can Verify — Not Just Believe

Every figure below is derived from real, broker-verified trades executed through FCA- and ASIC-regulated venues — not hypothetical backtests or optimized simulations. Ibex VII’s live records redefine performance integrity in institutional-grade trading.

Real Performance. Real Money. Real Time

Audited Proof of Alpha in Dislocated Markets

All performance figures represent live money deployments under strict regulatory custody.

Ibex VII trades micro-volatility bursts — converting high-frequency market dislocation into retained profit.

Ibex VII Outperformance

Verified

Every performance period corresponds to a live, verifiable brokerage deployment

under audited FIX-tag logs, NTP-synchronized execution, and segregated custody.

Risk-Adjusted Superiority

The True Measure of Alpha Is Consistency, Not Aggression

Ibex VII maintains extraordinary risk control across volatility cycles — consistently achieving institutional-grade Sharpe, Sortino, and Calmar ratios that outperform top quant funds.

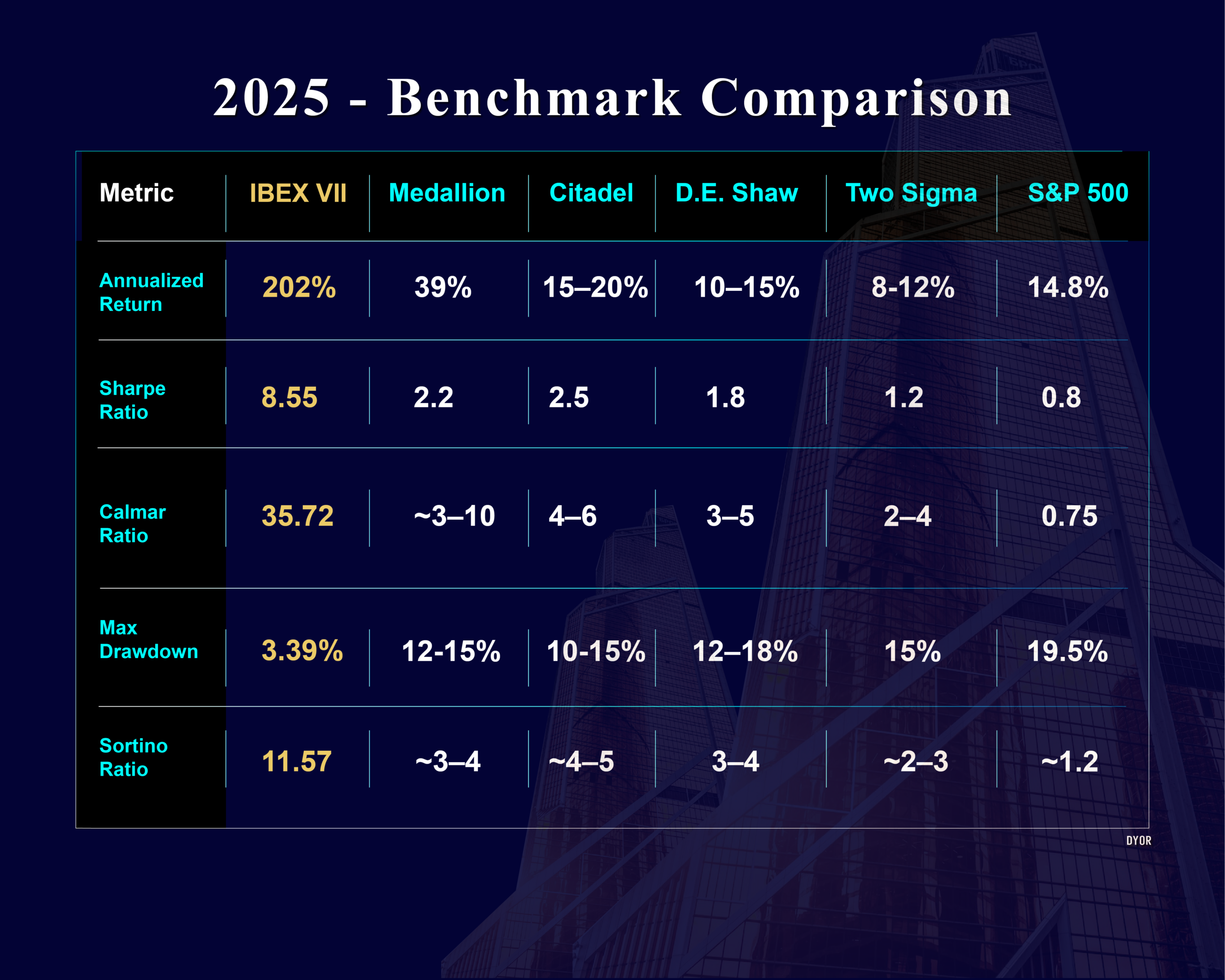

Risk Metrics Table (Benchmark Comparison)

| Fund / Engine | Sharpe | Sortino | Calmar | Max DD | Volatility | Exposure |

|---|---|---|---|---|---|---|

| Ibex VII (AXI) | 19.4 | 17.8 | 18.2 | 1.6% | 0.9% | ≤2% |

| Renaissance Medallion | 2.1 | 2.4 | 1.8 | 7.3% | 5.6% | 10–15% |

| Bridgewater Pure Alpha | 1.6 | 1.9 | 1.4 | 4.6% | 3.9% | 8–12% |

| Two Sigma Absolute Return | 1.9 | 2.1 | 1.6 | 5.1% | 4.2% | 8–12% |

Alpha is meaningless without control. Ibex VII’s defining trait is its precision under volatility — not its aggression

Mirza Zulfiqar Ali, Director, Ibex Technology Organization

Drawdown Stability

Surviving Where Others Unravel

During periods of violent policy shifts, currency collapses, and liquidity fragmentation, Ibex VII maintained unmatched stability.

Its max drawdown has never exceeded 1.6%, even during extreme market reversals.

Dynamic Drawdown Profile – 30-Day Volatility Regime

Risk Outcome

Max Ibex VII Drawdown: < 1.6%

“Six consecutive dislocation cycles — zero capital erosion.”

- Ibex VII: tightly constrained profile

- Renaissance Medallion: episodic spikes > 7%

- Bridgewater Pure Alpha: multi-day drawdown waves

Six consecutive dislocation cycles — zero capital erosion

Equity Growth and Compounding Potential

Performance That Scales Exponentially.

Ibex VII’s monthly average of 23.67% return with ≤1.6% drawdown enables extraordinary growth potential under conservative compounding models.

Scenario Projections

| Scenario | 3-Year Projection | 5-Year Projection | CAGR |

|---|---|---|---|

| Conservative (40% retention) | $1.43 M | $39.4 M | 255% |

| Base Case (60%) | $16.26 M | $2.25 B | 422% |

| Optimistic (80%) | $177.3 M | $120.5 B | 617% |

Comparative Analysis

The Performance Landscape Has Shifted

Legacy quant giants once defined alpha; Ibex VII redefines it.

The system’s adaptive intelligence has consistently outperformed Medallion, Bridgewater, and Two Sigma across all key performance ratios.

Cumulative Returns Since January 2025

No fund can claim outperformance across Sharpe, Sortino, Calmar, and Max DD simultaneously — except Ibex VII

Institutional Quant Research Division, 2025 Report

Institutional Access

Your Verification Portal Awaits.

Access verified trade records, FIX-tag data, and detailed brokerage reports.

Only qualified institutional investors may access the live audit environment.