IBEX

Engineering the Future of Systematic Intelligence

From Algorithmic Research to Institutional-Grade AI

Ibex Technology Organization is a quantitative research and trading technology firm developing autonomous AI systems that redefine market intelligence, risk control, and performance stability for global institutional investors.

The Ibex Vision

Institutional Intelligence, Redefined

At Ibex, we believe that artificial intelligence — when built with discipline, data integrity, and transparency — can elevate the financial ecosystem.

Our mission is to transform volatility into consistent growth through systems that think, adapt, and protect capital in real time.

Key Vision Pillars:

Every performance period corresponds to a live, verifiable brokerage deployment

under audited FIX-tag logs, NTP-synchronized execution, and segregated custody.

The Journey

From Concept to Global Deployment.

Ibex began as a private research initiative within a quantitative group focused on microstructure analysis and low-latency trading systems.

Over the years, it evolved into a global architecture spanning London, Sydney, Zurich, and Dubai, now powering institutional-grade AI trading engines like Ibex V, Ibex VII, and SideSwiper

| Year | Milestone |

| 2018 | Foundational R&D in FX volatility modeling begins. |

| 2020 | Launch of Ibex V prototype for internal alpha testing. |

| 2022 | Regulatory integrations with FCA and ASIC brokerage partners. |

| 2024 | Institutional performance verification with AXI and Alchemy. |

| 2025 | Global deployment of Ibex VII Reflex Engine — full live production. |

Alpha is meaningless without control. Ibex VII’s defining trait is its precision under volatility — not its aggression

Sir Mirza Zulfiqar Ali, Director, Ibex Technology Organization

The Organization

A Research-Driven Structure for Institutional Trust

Ibex operates as a decentralized quantitative research organization with specialized divisions that ensure both innovation and compliance.

| Division | Function |

| Quantitative Research Division | Strategy design, AI model development, statistical optimization. |

| Execution & Infrastructure Division | Low-latency routing, FIX protocol integrity, and broker integrations. |

| Regulatory & Audit Division | Oversight, data retention, KYC/AML compliance, and legal audit coordination. |

| Institutional Relations Division | Investor onboarding, partnership programs, and global outreach. |

Leadership & Governance

Led by Researchers, Not Marketers.

Our leadership team consists of quantitative engineers, institutional strategists, and market structure specialists with decades of combined experience across global financial systems. Every division operates under a dual mandate of innovation and accountability.

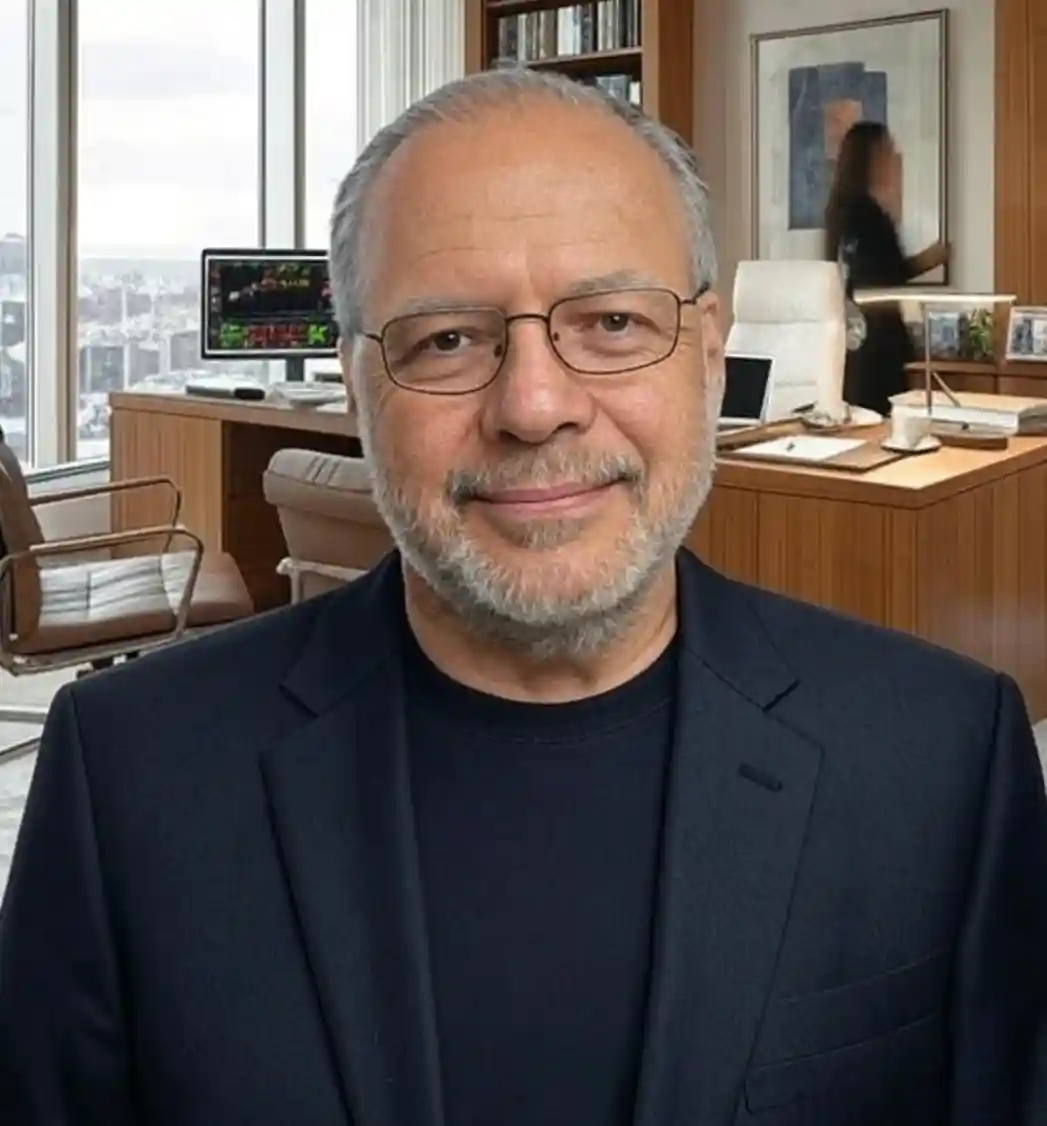

Zulfiqar Ali

Founder & Chief Research Architect

Pioneer in AI microstructure systems and institutional-grade risk frameworks.

Raphaël Ribeaucourt

Head of Institutional Relations, Europe

Former BNP Paribas executive; leads Ibex institutional integration

Gavin Ward

Strategic Advisor, Institutional Investments

Golbal Head of Business Development at AxiCorp Fininicial Services Pty Ltd

Zulfaqar Siddiqi

Invester Relations Executive

Specializing in Institonal Onboarding & Strategic Capital Partnership

Regulatory Integrity

Regulated Environments. Verified Execution.

Ibex operates exclusively through fully regulated brokerage partners under FCA (UK) and ASIC (Australia) supervision.

All live executions are logged via FIX-tag lineage and validated through independent audit trails.

No fund can claim outperformance across Sharpe, Sortino, Calmar, and Max DD simultaneously — except Ibex VII

Institutional Quant Research Division, 2025 Report

Institutional Access

Your Verification Portal Awaits.

Access verified trade records, FIX-tag data, and detailed brokerage reports.

Only qualified institutional investors may access the live audit environment.

The Ibex Architecture

A Synthesis of AI, Market Microstructure, and Human Insight

At the core of Ibex lies a continuously evolving AI engine that combines real-time market data ingestion, reflexive decision-making, and microsecond execution integrity. Each iteration of Ibex builds upon millions of historical and live data points, creating a learning system that adapts faster than market cycles evolve.

Global Presence

Where Innovation Meets Regulation

London, Zurich, Dubai, and Sydney form the live coordination grid across institutional strategy, risk management, capital strategy, and brokerage infrastructure.

🇬🇧

London (UK)

Institutional Strategy & Quantitative Research

🇨🇭

Zurich (Switzerland)

Risk Management & Capital Strategy

🇦🇪

Dubai (UAE)

Institutional Development & Investor Relations

🇦🇺

Sydney (Australia)

Infrastructure & Brokerage Coordination

Cyan routes represent real-time coordination channels with subtle data trails across offices.

Ibex began as a private research initiative within a quantitative group focused on microstructure analysis and low-latency trading systems.

Over the years, it evolved into a global architecture spanning London, Sydney, Zurich, and Dubai, now powering institutional-grade AI trading engines like Ibex V, Ibex VII, and SideSwiper

| Year | Milestone |

| 2018 | Foundational R&D in FX volatility modeling begins. |

| 2020 | Launch of Ibex V prototype for internal alpha testing. |

| 2022 | Regulatory integrations with FCA and ASIC brokerage partners. |

| 2024 | Institutional performance verification with AXI and Alchemy. |

| 2025 | Global deployment of Ibex VII Reflex Engine — full live production. |

Alpha is meaningless without control. Ibex VII’s defining trait is its precision under volatility — not its aggression

Mirza Zulfiqar Ali, Director, Ibex Technology Organization

Our Philosophy

Data-Driven. Discipline-Led. Performance-Verified.

Our commitment is to redefine wealth creation through verifiable intelligence — where every performance metric, trade, and decision stands on empirical truth, not marketing narrative.

At Ibex, we build systems that prove themselves.

“Markets are complex. Truth is measurable.” — Quantitative Research Division

Careers & Collaboration

Join the Architecture of the Future

We invite exceptional minds in AI, quantitative research, and institutional strategy to join our journey toward the next era of financial intelligence.